There is an old saying: Never feed a bear no matter how well-stocked your picnic basket might be. Despite the economic growth that is happening within the United States, do not think a bear market can’t and won’t happen because it will.

Never turn your back!

It would of course be nice to have the booming growth in the economy along with the protection of bear markets turning up unannounced. In the year 2021, the GSP growth will be at 6.6%. A projection made by the Conference Board. The Bank of America is forecasting a growth rate of 6.5%. Both of these estimates are over double of what the figures were each year over the past 50 years with the average rate at 2.7%.

So where is the doom and gloom of the bear market when figures projected look so promising? Well, it all comes from the National Bureau of Economic Research, which announced the recession caused by the Covid-19 pandemic came to a 15-month end.

The coincided with the bear market ending at the same time down on Wall Street. And you would be forgiven to think that the two were mutually correlated in any given recession. However, you would, in fact, be wrong in making the assumption that the two were mutually exclusive.

The issue comes first with the stock market and its natural instinct to anticipate a recession months before it actually happens. What you still have though is a growing market because preparedness doesn’t stop the money from flowing. The will still be the case when the bear market appears during this upward trajectory of spending.

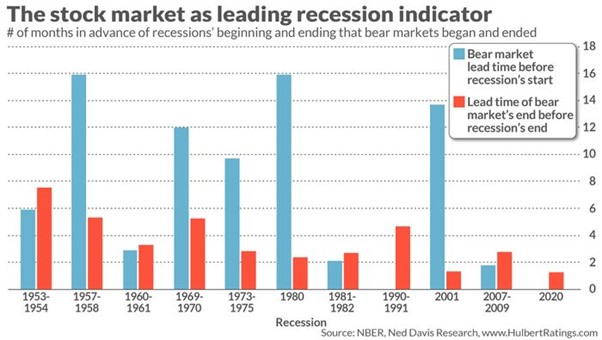

In the illustrated chart below, it reports the lead times of a bear market since the U.S recession back in 1950. What this chart highlights is that a bear market tends to come in 7.2 months before the recession hitting.

As you can also see, that when the recession comes to an end, though the times may be shorter than at the start, the average comes to 3.6 months for the bull markets to appear again.

In both of these cases, major trends can be learned about how the stock markets maneuver whether it happens with an expanding or contracting market. You can look at this in another light. The stock market is continually looking forward in anticipation of what is to come. What the current market gives us is something long been baked into the prices of stocks; they are inevitable trends.

Another reason for being wrong with regards to the bear market and thinking it cannot occur in such times of economic growth is that some bear markets will appear without a recession. This has happened a total of nine times since 1950, according to Ned Davis Research.

So, what are the causes of this? Well, it could have something to do with equities coming in ahead of fundamentals. An example of this would be found in a case of the economy growing whilst stock valuations were lowering.

Another plausible cause for the bear markets to trigger within an upward economy could trigger from an exogenous event, something that doesn’t have the normal widespread impact. Examples of this have been seen in 1998 during the bankruptcy of the Long Term Capital Management. In a six-week period, S&P stock fell 21% each day. That’s one big bear right there.